AVAILABLE PROPERTIES BY LOCATION

Latest Listing Here

See the latest properties available today!

FOR SALE: 2BR Condo in Cityland Pasong Tamo – Estacion ₱ 4,500,000.00

FOR SALE: 2BR Condo in Cityland Pasong Tamo – Estacion

₱ 4,500,000.002BR 1 Maids Room 2TB 69sqm Cityland Pasong Tamo Calle Estacion is located in Makati, one of the top cities in Metro Manila. this is a good buy for people looking for investment or homes near schools like Don Bosco Makati, and Colegio De San Agustin. It is situated just a stone’s throw away from […]

FOR SALE: 3BR with Parking Penhurst Place BGC ₱ 22,000,000.00

FOR SALE: 3BR with Parking Penhurst Place BGC

₱ 22,000,000.00CONDO UNIT FOR SALE 🏙 Location: Penhurst Park Place,1st Avenue, 30th Street, Crescent Park, 1st Ave, BGC 🏠 Unit Size: 94 sqm 🛏 Bedrooms: 3 + 1 maid’s quarter 🛁 Bathrooms: 3 (including maids’ quarters) 🚗 Parking: Yes, included! This stunning 3-bedroom unit with maid’s quarter boasts not only spacious living but also top-notch amenities […]

FOR SALE: 1BR + Parking Green Residences Taft Avenue Manila ₱ 5,000,000.00

FOR SALE: 1BR + Parking Green Residences Taft Avenue Manila

₱ 5,000,000.00RUSH! For Sale Condo Unit GREEN RESIDENCES Taft Avenue Manila FA: 28.82 1BR 1TB 1 Parking P5M Doah Sto Tomas 0917 163 1625 0922 813 5914 PRC: 0003413 DHSUD: 00802 Related posts: FOR SALE: 1BR with Parking in AVIDA SUCAT Condo for sale along Eight Avenue corner McKinley Parkway BGC Mid-rise Condo in Metro Manila […]

FOR SALE: Town House in Paranaque City ₱ 8,900,000.00

FOR SALE: Town House in Paranaque City

₱ 8,900,000.00Unit 3, Carfel Townhouses, Anastacio St., Teoville 3, Paranaque City. (At the back of Sinangag Express along Presidents Ave. Near SM BF & Tahanan Village) Lot – 59 Sqm. Floor – 90 Sqm. 3 Bedrooms 2 Toilet & Bath 2 Storey 4 Split Type Inverter Aircons Solar panel CCTV Renovated To BNEW Compound type Townhouses […]

Fully Furnished 1-Bedroom Unit in Sun Residences ₱ 3,800,000.00

Fully Furnished 1-Bedroom Unit in Sun Residences

₱ 3,800,000.00Sun Residences is located in España Boulevard cor. Mayon St., Brgy. Sta. Teresita, Q.C. Only 2km drive to University of Sto. Tomas (UST) UNIT DETAILS: Tower 1, 10th Floor Floor Area: 27.90 sqm View: Facing Amenity/Manila View UNIT INCLUSIONS: ✔ Built-in cabinet ✔ Shoe Cabinet ✔ Split Type Aircon ✔ Heater ✔ Microwave ✔ Refrigerator […]

5 Bedroom House in Ayala Alabang ₱ 200,000,000.00

5 Bedroom House in Ayala Alabang

₱ 200,000,000.00𝟓 𝐁𝐞𝐝𝐫𝐨𝐨𝐦 𝐇𝐨𝐮𝐬𝐞 𝐅𝐨𝐫 𝐒𝐚𝐥𝐞 𝐢𝐧 𝐀𝐲𝐚𝐥𝐚 𝐀𝐥𝐚𝐛𝐚𝐧𝐠 𝐕𝐢𝐥𝐥𝐚𝐠𝐞 STATUS: Under Construction UNIT INFOS 𝗕𝗮𝘀𝗲𝗺𝗲𝗻𝘁: Ante Room • Mud Room • Elevator Lobby • 3-4 Car Garage • Auxiliary Kitchen • Help’s Room with T&B • Driver’s Room with T&B • Service Hallway • Storage room • Pump Room • Generator Room 𝗚𝗿𝗼𝘂𝗻𝗱 𝗙𝗹𝗼𝗼𝗿: Porch […]

3BR Unit with Balcony in Sampaloc ₱ 8,000,000.00

3BR Unit with Balcony in Sampaloc

₱ 8,000,000.00This mid-rise condo is strategically located in a residential area, which means you still get that community vibe despite being close to major establishments. It is a good investment for foreigners, OFWs, investors, parents of incoming college students, and those who are currently studying within the University Belt and in nearby schools in QC. AMENITIES […]

FOR SALE: 1BR with Parking in AVIDA SUCAT Call for price

FOR SALE: 1BR with Parking in AVIDA SUCAT

Call for priceRUSH FOR SALE! Avida Sucat Condo 1 Bedroom 30sqm 1 Covered Parking Furnished with the following: 1 double deck bed (made to order) cabinet with AC, 1 big Sofa, 1 TV 1 Dining Set, 1 Refrigerator, Stove microwave DOAH STO. TOMASMOBILE NO.: 09171631625 / 0922 8135914 doah1127@gmail.com PRC No.: 0003413DHSUD No.: 00802 Related posts: […]

3 Bedroom in Parkview 1 Eastwood Quezon City ₱ 12,500,000.00

3 Bedroom in Parkview 1 Eastwood Quezon City

₱ 12,500,000.00FOR SALE Tower 1 Parkview 1 106.50 sqm 3 BR 1 maids qtr 2 TB., includes 3 split type aircon, 1 window aircon. Furnished REB Doah Sto Tomas 0922 8135914 0917 163 1625 Related posts: FOR SALE: 1BR + Parking Green Residences Taft Avenue Manila Fully Furnished 1-Bedroom Unit in Sun Residences PAG IBIG LOANABLE […]

FOR SALE! Commercial Buildings in Mandaluyong ₱ 85,000,000.00

FOR SALE! Commercial Buildings in Mandaluyong

₱ 85,000,000.00𝗣𝗥𝗘-𝗦𝗘𝗟𝗟𝗜𝗡𝗚 𝗖𝗢𝗠𝗠𝗘𝗥𝗖𝗜𝗔𝗟 𝗕𝗨𝗜𝗟𝗗𝗜𝗡𝗚𝗦 𝗶𝗻 𝗠𝗮𝗻𝗱𝗮𝗹𝘂𝘆𝗼𝗻𝗴! 2 Commercial Buildings Lot Area: 222-224 sqm Floor Area: 1027-1049 sqm 3-4 Carports 5-Storey with Mezzanine Floor 10 Commercial Spaces Powder Room Lobby Elevator Price: 85M negotiable Related posts: Preselling Smart Condo in Mandaluyong FOR SALE TOWNHOUSE in ADDITION HILLS SAN JUAN Prime Commercial Lot for Sale at Alabang West […]

FULLY FURNISHED BRAND NEW TOWNHOUSE IN CUBAO ₱ 27,700,000.00

FULLY FURNISHED BRAND NEW TOWNHOUSE IN CUBAO

₱ 27,700,000.00FULLY FURNISHED BRAND NEW TOWNHOUSE IN CUBAO 5 minutes to Araneta Center 15 minutes to Atene de Manila & UP Diliman READY FOR OCCUPANCY UNIT INFORMATION GF: 2 Car garage, Maid’s Room with T&B, Foyer 2F: Living, Dining, Kitchen, Powder Room, Service Area, Balcony 3F: Masters Bedroom 1 w/ WIC & T&B, […]

– Prime location, very accessible to private and public transportation – Absolutely Flood Free! – 20 meters above sea level. – Easy access to malls, supermarkets, various commercial establishments, cafes, banks, and more. Community Amenities and Features – A very exclusive and low density community of only 197 units, all detached homes. – Fully gated […]

FOR SALE: FULLY FURNISHED TAGAYTAY HOUSE AND LOT WITH SWIMMING POOL All appliances and furnitures included. ➤ Inside subdivision in Magallanes Drive ➤ Near Magallanes Square, Leslies Bulalohan, Skyview Restobar, Picnic Grove, Sky Ranch, and Mahogany Market ➤ Not overlooking Lot Area: 172 sqm Floor Area: 165 sqm Pool Area: 25 sqm Bedroom: 3 Toilet […]

Lot for Sale in Tagaytay Heights ₱ 4,300,000.00

Lot for Sale in Tagaytay Heights

₱ 4,300,000.00Tagaytay Heights is strategically located along Mahogany Avenue. Proximity to some important establishments: City College of Tagaytay – 500m Mahogany Market – 650m Ospital ng Tagaytay – 1.0km Savemore Market Mendez – 2.0km Our Lady of Lourdes Parish – 2.9km Ayala Malls Serin – 3.1km Tagaytay Medical Center – 3.7km Lot Details Lot Size: 260 […]

Fully Furnished Townhouse near Molino Boulevard ₱ 4,390,000.00

Fully Furnished Townhouse near Molino Boulevard

₱ 4,390,000.00The townhouse unit is READY FOR OCCUPANCY and all furnitures and fixtures are included on an “as-is where-is” basis. ✓ Located in a gated subdivision ✓ Walking distance from Molino Boulevard ✓ Very accessible to 24-hour public transpo Subdivision Amenities: Adult & Kiddie Pool Lap Pool Clubhouse and Function Rooms Playground Selling Price: 4,390,000 Downpayment […]

East Facing-Modern Smart Home Gated community with security No Issues with Meralo and Maynilad and super fast Converge Internet Fully Furnished Clean Title with 1 Powder Room, Big Kitchen Room, Laudry Area, Patio Space Koy/Fish Pond If interested PM call Text for more details 0935-652-3441 Related posts: 3Bedroom Bungalow For sale in BF Homes Paranaque […]

Corner Lot with Maid’s / Office Room only 3mins from Paranaque City Hall Pm to schedule a property viewing 0935-652-3441 Related posts: Mid-rise Condo in Metro Manila Quezon City 3Bedroom Bungalow For sale in BF Homes Paranaque Preselling 4 Bedroom Condo in San Juan Luxury condo for sale along Macapagal Blvd, Pasay City

3Bedroom Bungalow For sale in BF Homes Paranaque ₱ 17,300,000.00

3Bedroom Bungalow For sale in BF Homes Paranaque

₱ 17,300,000.00Newly Renovated Located in Bf Homes Paranaque Maid’s Room with toilet and bath Related posts: 4-Bedroom Townhouse in BF Homes Paranaque Exclusive 3-Storey Townhouse in Sucat Paranaque Brand New 3-Bedroom Townhouse near Alabang RUSH! 3-Bedroom Bungalow House for Sale near SM Bacoor (CLEAN TITLE)

Resale! Premium Residential Lot in Antel Grand Village ₱ 4,500,000.00

Resale! Premium Residential Lot in Antel Grand Village

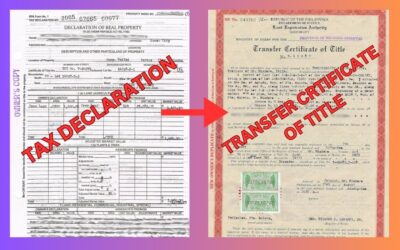

₱ 4,500,000.00LOCATION: Grand Meadows at Antel Grand Village in Brgy. Bacao II, General Trias, Cavite Approx. 23km drive from SM Mall of Asia Lot Area: 176 sqm (facing morning sun) – Clean Title – w/ updated Real Property Tax For more details and viewing appointment, please contact me. Related posts: 4-Bedroom Townhouse in BF Homes Paranaque […]

RFO 1 Bedroom Condo in Las Pinas City ₱ 2,433,201.38

RFO 1 Bedroom Condo in Las Pinas City

₱ 2,433,201.38Ready for Occupancy Condo near Bamboo Organ Church Nearby Establishments: – C5 Road Extension – All Home C5 (1.1 km) – SM Sucat (2.6 km) – Bamboo Organ Church (0.65 km – NAIA Terminal 1 (5.2 km) – Mall of Asia FEATURES & AMENITIES • Commercial Spaces • Back-up Power Supply • Low-rise Condominium with […]

Beach Lot for Sale in Laiya, Batangas ₱ 11,926,000.00

Beach Lot for Sale in Laiya, Batangas

₱ 11,926,000.00Wake up to the calming sound of the ocean waves and breathe in that fresh sea breeze. Indulge in an early morning swim or spend time with family and friends on the pristine sands of Laiya beaches. Drive out and explore the Laiya estate and take home something special for family and friends. Celebrate life’s […]

House and Lot for sale in Binan, Laguna ₱ 1,500,000.00

House and Lot for sale in Binan, Laguna

₱ 1,500,000.00Related posts: Mid-rise residential condominium in Southwoods City, Binan Laguna House and Lot in Ciudad de Calamba, Laguna Premier Lots for sale in the heart of Nuvali, Sta. Rosa Laguna

882 sqm Commercial Corner Lot in Crestkey Estates ₱ 63,063,000.00

882 sqm Commercial Corner Lot in Crestkey Estates

₱ 63,063,000.00Crestkey Estates is strategically located in Silang, one of the fastest developing municipalities in Cavite. Easily accessible via the Sta. Rosa-Tagaytay Road and Cavite-Laguna Expressway (CALAX), this newest commercial landmark will allow residents and visitors to enjoy the conveniences of living near the metro while experiencing the peace and tranquility of the South. This highly […]

Prime Commercial Lot Beside Chiang Kai Shek College ₱ 51,337,000.00

Prime Commercial Lot Beside Chiang Kai Shek College

₱ 51,337,000.00Crestkey Estates is situated right beside Chiang Kai Shek College South Forbes, creating a synergetic relationship with the school as it brings its prestige and distinct brand of learning excellence to the community. Flexible commercial spaces allow for a diverse array of retail, office, restaurant, and entertainment options to meet the discerning demands of a […]

Residential Corner Lot at Pious Heights, Tagaytay ₱ 2,200,000.00

Residential Corner Lot at Pious Heights, Tagaytay

₱ 2,200,000.00Located in Maitim 2nd East, Tagaytay City 1.7km drive to/from Pink Sisters Convent 2.2km drive to/from Olivarez Plaza 2.4km drive to/from Fora Mall 2.8km drive to/from Ayala Malls Serin 3.4km drive to/from Our Lady of Lourdes Parish 5.8km drive to/from Sky Ranch Lot Area: 200 sqm Asking Price: 2.2M Net CLEAN TITLE For complete details […]

Commercial Lot for Sale at Southwoods City ₱ 100,027,000.00

Commercial Lot for Sale at Southwoods City

₱ 100,027,000.00Great Location! Great Investment! Only 4 lots available! Southwoods City is a carefully master-planned tourism estate at the heart of Carmona and GMA Cavite and Biñan, Laguna. Complete with all the necessities for an active, well-rounded, and privileged lifestyle, this mixed-use development highlights its “golf” component to the lifestyle concept with the 125-hectare Jack […]

Preselling 2 Bedroom Townhouse near Southwoods ₱ 3,800,000.00

Preselling 2 Bedroom Townhouse near Southwoods

₱ 3,800,000.00Delightfully located where southern tranquility meets convenience. Just 600 meters away from the southwoods exit, you’re merely a minute away from life’s bustle while being safe in a secure community. Bask in the familiar southern charm, while reveling in suburban conveniences. CONVENIENCES NEARBY 1km away from Southwoods Mall 1.5km away from Unihealth Hospital 3.5km away […]

Prime Commercial Lot for Sale at Alabang West ₱ 225,540,000.00

Prime Commercial Lot for Sale at Alabang West

₱ 225,540,000.00Invest now in expansive commercial lots in the South! Low investment starts at 5% DP Up to 48 months to pay Lot size ranges from 950 sqm to 1,260 sqm Architectural Theme: Beverly Hills-themed lifestyle concept Allowable Uses: Allowed commercial uses are retail and services, food & beverage, offices, leisure and recreational use. For more […]

Residential Lot for Sale in Hacienda Escudero ₱ 7,236,514.00

Residential Lot for Sale in Hacienda Escudero

₱ 7,236,514.00Own your own Hacienda! Hacienda Escudero takes homeowners back to a simpler and more meaningful way of life. It integrates Filipino culture into every aspect of living while providing all the modern amenities and facilities needed to ensure a relaxed and laid back lifestyle. Set on the Escudero ancestral lands, this sprawling 180-hectare property is […]

Brand New 4-Bedroom House near the Beach ₱ 9,500,000.00

Brand New 4-Bedroom House near the Beach

₱ 9,500,000.00Your home away from home, your residence beside a private pristine beach and nature’s sanctuary. It is your one foot inside a sprawling eco-prime development in the exclusive part of Laiya Ibabao, San Juan, Batangas: a leisure waterfront enclave with a first-rate beach club, a commercial complex and more in the future. AMENITIES Beach Clubhouse […]

Preselling 2-Storey Townhouse in Tandang Sora ₱ 7,400,000.00

Preselling 2-Storey Townhouse in Tandang Sora

₱ 7,400,000.00Near Pacific Global Medical Center, Saint Charbel Executive Village and Carmel V Mindanao Avenue TARGET TURN OVER : January 2022 4 UNITS Floor Area : 117sqm Lot Area : 60sqm Bedroom : 3 + Loft + Maid’s room Toilet and Bath : 3 Garage: 1 to 2 car Pre-selling Price : 7,400,000.00 Note: ( Price […]

Located in Camella Homes, Bacoor, Cavite Hindi binabaha Lot area: 192 Sqm Floor area: 150 Sqm House Features: – 3 bedrooms – 2 C.R. – Dirty Kitchen – Laundry Area – Parking space for 2 cars (pwede din sa labas kasi wide road) *1 ride to/from SM Bacoor *Walking distance to: GAS stations RCBC Bank […]

Corner Lot for Sale in Betterliving ₱ 9,500,000.00

Corner Lot for Sale in Betterliving

₱ 9,500,000.00Near Ospital ng Parañaque II CLEAN TITLE Lot Area: 320 sqm Selling Price: 9.5M net Capital Gains Tax and Transfer Fees will be shouldered by the buyer. Contact me for more details and viewing appointment. Related posts: Luxury condo for sale along Macapagal Blvd, Pasay City 4-Bedroom Townhouse in BF Homes Paranaque Preselling House and […]

Old House for Sale in San Andres Bukid ₱ 16,000,000.00

Old House for Sale in San Andres Bukid

₱ 16,000,000.00Its location has a great potential for a 2 to 3-storey apartment or townhouse development, as the property is located very near Osmeña Highway and Taft Avenue. Lot Area: 145 sqm Asking Price: 16M net Capital Gains Tax (CGT) and transfer fees will be shouldered by the buyer For more details and viewing appointment, please […]

NO Required Income! 2-Storey Townhouse in Las Piñas ₱ 5,010,000.00

NO Required Income! 2-Storey Townhouse in Las Piñas

₱ 5,010,000.00A 128-unit housing development located in Manuyo Dos, Las Piñas City A community that is highly accessible to all your needs. Nearby establishments are Liana’s Supermarket & Dept. Store,SM Supermalls, Vistal Mall Global South, Puregold, S&R Membership Shopping and Las Pinas City Hall. It is also accessible to nearby hospitals such as Las Piñas Doctors […]

Corner Lot for Sale in Bangkal, Makati ₱ 173,600,000.00

Corner Lot for Sale in Bangkal, Makati

₱ 173,600,000.00Located along South Super Highway NEARBY ESTABLISHMENTS: Bangkal High School Ever Supermarket South Star Plaza CW Home Depot Wilcon Depot Lot Area: 868 sqm Price per sqm: 200,000 For more details and viewing appointment, please contact me. Related posts: Luxury condo for sale along Macapagal Blvd, Pasay City 4-Bedroom Townhouse in BF Homes Paranaque Preselling […]

Commercial Lot for Sale at Filinvest City, Alabang ₱ 376,200,000.00

Commercial Lot for Sale at Filinvest City, Alabang

₱ 376,200,000.00Highly accessible by commuting or driving. It is located along Civic Drive. Just a walking distance from Festival Supermall, Landmark Supermarket & Dept. Store, South Station, Asian Hospital & Medical Center, Muntinlupa Hospital, and Starmall Alabang Lot Area: 1,254 sqm Asking Price: 300,000/sqm (VAT exclusive) For more details and viewing appointment, please contact me. Related […]

Furnished 2 Bedroom Unit at Spring Residences ₱ 29,000.00

Furnished 2 Bedroom Unit at Spring Residences

₱ 29,000.00Newly hand over and improved. Currently 2 bedrooms has no aircon but we will install once tenant confirmed Max. 4 persons Unit Details: > Brand new (recently turned over) > Family Suite A with balcony > 28.01 sqm > 2 bedrooms, 1 bathroom CONVENIENT LOCATION > Beside SM Bicutan > Near Bicutan exit (SLEX and […]

For Sale: Industrial Lot in Silang ₱ 49,900,000.00

For Sale: Industrial Lot in Silang

₱ 49,900,000.00Just 20 kilometers outside Metro Manila, Cavite Light Industrial Park’s (CLIP) location provides convenient access for major thoroughfares, as well as multi-skilled bilingual workforce and facilities that enhance the efficiency of business operation in an environmentally sound community. READY FACILITIES ‣ 50,000 & 112,000 Gallons Capacity Water Tanks ‣ Sewage Treatment Plant and Underground Drainage […]

Preselling Commercial Beach Lot in Laiya ₱ 109,651,000.00

Preselling Commercial Beach Lot in Laiya

₱ 109,651,000.00CLUB LAIYA is a 24-hectare master-planned BeachTown development located in Laiya, San Juan, Batangas. Club Laiya offers residential-commercial lots for sale (LTE), resort amenities and experiences (MRC) and in the near future. Condotels for investment (Spinnaker, etc), making every square inch of Club Laiya a BeachTown. CLUB LAIYA is the epitome of leisure living, a […]

Preselling House and Lot in Sto. Tomas, Batangas ₱ 1,949,000.00

Preselling House and Lot in Sto. Tomas, Batangas

₱ 1,949,000.00Le Moubreza Phase 3 is located in Brgy. San Antonio, Sto. Tomas, Batangas 👉 Jasmine Single Attached MA thru Bank Financing for 20 years: 15,222.00 MA thru PAGIBG Financing for 30 years: 8,333.00 👉 Jasmine Duplex MA thru Bank Financing for 20 years: 13,677.00 MA thru PAGIBG Financing for 30 years: 10,170.00 House Turnover: Bare […]

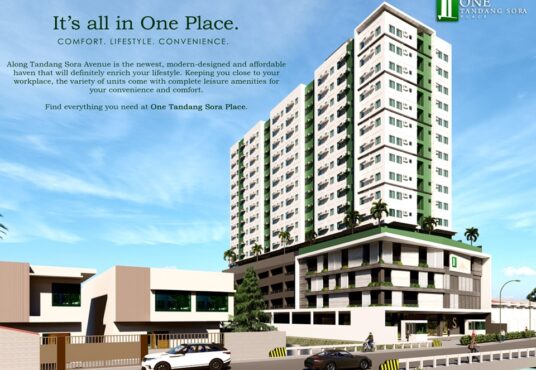

PAG IBIG LOANABLE Pre Selling Condo in Tandang Sora Quezon City! UP Town Center – (6.7Km : 14mins away) Trinoma – (6.5Km : 12 mins away) Ayala Mall Vertiz North – (6.3Km : 11mins away) U.P.-Ayala Land Techno hub (3.5Km: 6mins away) SM North Edsa – (7Km : 15mins away) Soon To Rise The Junction […]

Ready for Occupancy 3-Bedroom Corner House ₱ 25,900,000.00

Ready for Occupancy 3-Bedroom Corner House

₱ 25,900,000.00Located in a quiet, well-secured and well-maintained subdivision with complete amenities. Lot Area: 316 sqm (Corner/Perimeter Lot) Floor Area: 185.1 sqm House Features: Master’s Bedroom with Wardrobe Cabinet, T&B and Small Balcony 2 Regular Bedrooms Family Hall Common T&B in the 2nd floor Living, Dining & Kitchen Area Powder Room Maid’s Room with separate T&B […]

Fully Finished 3-Bedroom House in Caloocan ₱ 4,600,000.00

Fully Finished 3-Bedroom House in Caloocan

₱ 4,600,000.00BluHomes Gakakan is an eco-friendly housing development in Amparo Village, North Caloocan City. It is a certified green building development certified by EDGE of World Bank, designed to be passively cooled, energy-efficient and water-efficient. Only one tricycle ride away from Quirino Highway and the future MRT-7, which will conveniently connect the future homeowners to the […]

RFO Fully Furnished Penthouse Unit in San Juan ₱ 45,000,000.00

RFO Fully Furnished Penthouse Unit in San Juan

₱ 45,000,000.00FULLY FURNISHED PENTHOUSE UNIT in SAN JUAN CITY LOCATION IS KING Baron Tower is prized for its close proximity to premier residential subdivisions, dining & retail centers, schools & hospitals. DESIGNED FOR LUXURY Designed by Budji Layug + Royal Pineda, Baron Tower is conceptualized to be San Juan’s new icon. FULL BUILDING FEATURES AND AMENITIES […]

Preselling 4 Bedroom Condo in San Juan ₱ 16,814,865.33

Preselling 4 Bedroom Condo in San Juan

₱ 16,814,865.33The Baron LVXE Residences is a modern and plush condominium set to rise in a quiet and peaceful neighborhood of San Juan. The Baron LVXE Residences will be a low density project with only 76 spacious units for the entire building. Offering a more nurturing and laidback atmosphere for starting families, the project hopes to […]

FOR SALE!! Brand New 1-Bedroom Beach Condo with Parking ₱ 7,635,600.00

FOR SALE!! Brand New 1-Bedroom Beach Condo with Parking

₱ 7,635,600.00Interested in a beach property but prefer a condo? Get a Seafront Villa. The Seafront Villas is a collection of low-rise condominium in a master-planned community overlooking the serene waters of Tayabas Bay and the slopes of mystical Mount Banahaw. It is the perfect location for homebuyers who are looking for a place close to […]

5-Bedroom Single Detached House near Alabang ₱ 39,958,000.00

5-Bedroom Single Detached House near Alabang

₱ 39,958,000.00Where the elegance and stately ambiance of FRENCH sophistication is exquisitely recreated in the heartland of the metropolis. Its convenient location places you in the center of everything. Here, every twist and turn is calculated to bring you closer to the places that matter—schools, hospitals, leisure destinations. Step outside your doors and the bustling city […]

Commercial Lot along Daang Hari ₱ 156,794,400.00

Commercial Lot along Daang Hari

₱ 156,794,400.00Near Evia Mall and Ayala Alabang Strategically located along the frontage of an exclusive subdivision. Available Lots: 869 sqm to 1,340 sqm Selling Price starts at 130M (VAT inclusive) For more details and site viewing appointment, please contact me. “Strictly for Direct Buyers only” Related posts: Prime Commercial Lot near Ayala Alabang Brand New Single […]

Light Industrial Lot for Sale in Silang ₱ 44,622,450.00

Light Industrial Lot for Sale in Silang

₱ 44,622,450.00Planning to expand or relocate your warehouse and assembly operations in the fast progressing south? How about expanding your business operations or making an investment? Industrial and commercial lots for sale at Cavite Light Industrial Park (CLIP) located in Silang, Cavite. Key Developments to look forward to: *5 to 10 minutes away from the Silang […]

Beach Lot for Sale in Laiya ₱ 14,808,528.00

Beach Lot for Sale in Laiya

₱ 14,808,528.00A BALANCED LIFE IS A TANTAMOUNT TO A LEISURELY LIFE… The ‘new normal’ has provided an opportunity to reflect and realize how beneficial it is to live a life of balance. With WFH, you now spend more time with family, more time to learn new things, more time for health and wellness, all while maintaining […]

PRESELLING Cluster Type House with Carport in Naic ₱ 2,643,353.00

PRESELLING Cluster Type House with Carport in Naic

₱ 2,643,353.00A house and lot for sale in the vicinity of NAIC, Cavite. A modern design home with carport you will love to own. The subdivision is located along the road of Governors Drive, it is near to Cavite Technopark and Saddle & Clubs Leisure Park. A peaceful place good for people looking for a home […]

Ready for Occupancy Single Attached House near Alabang ₱ 32,961,100.00

Ready for Occupancy Single Attached House near Alabang

₱ 32,961,100.00Looking for a RFO house? We have a newly constructed house located inside a French Mediterranean Themed Subdivision, a high end development near Ayala Alabang. FLOOD FREE!! SUBDIVISION AMENITIES Clubhouse • Spa • Sauna • Jacuzzi • Playground • Tennis Court • Basketball Court • Pool Complex • Trellis • Cabanas • Gazebo • Function […]

Ready for Occupancy 4-Storey Townhouse with Elevator ₱ 41,500,000.00

Ready for Occupancy 4-Storey Townhouse with Elevator

₱ 41,500,000.00Located inside Horseshoe Village, QC. Lot Area: 129 sqm Floor Area: 461 sqm Features: 3 Car Garage | Concrete Roofdeck | 4 Bedrooms | 7 Toilet & Bath | Elevator | Balconies | Electric Fence | High-end Finishes Downpayment: 20% of TCP Balance payable thru cash or bank CONTACT US for complete details and viewing […]

RFO 3-Bedroom House with 2-Car Garage in Mandaluyong ₱ 34,000,000.00

RFO 3-Bedroom House with 2-Car Garage in Mandaluyong

₱ 34,000,000.00A quiet oasis located in the middle of Mandaluyong City. With key areas in the metro just 10 minutes away, navigate with ease to Rockwell Center, Makati CBD, Greenhills, and even Ortigas Center. Its strategic location puts you a stone’s throw away from glamorous hopping destinations as well as major business districts giving you options […]

Brand New 3-Storey Single Detached House with 2-Car Garage ₱ 34,000,000.00

Brand New 3-Storey Single Detached House with 2-Car Garage

₱ 34,000,000.00UNIT SPECIFICATIONS 2 Car Garage 3 Bedroom 3 T&B with walk-in closet Helper’s Room with T&B Garden Area Service Area Utility Kitchen SPECIAL FEATURES Multi-Point Water Heaters (All T&B except Helper’s Room) Intercom System Compound CCTV Split-Type Inverter Airconditioners Wood Accents Bravat Bathrooms Fixtures Heat & Smoke Detectors Pin Lights & Lighting Fixtures Panasonic Lighting […]

Brand New 3-Bedroom Townhouse with 2-Car Garage (Corner Unit) ₱ 28,750,000.00

Brand New 3-Bedroom Townhouse with 2-Car Garage (Corner Unit)

₱ 28,750,000.00Have a taste of cozy Brooklyn living right in the heart of Mandaluyong City. Lot Area: 106.22 sqm (Corner Unit) Floor Area: 230.90 sqm UNIT DETAILS Ground Floor: 2 Car Garage (side by side), Living, Maid’s Room with Toilet & Bath, Powder Room, Service Area Second Floor: Master’s Bedroom with walk-in closet and toilet & […]

Brand New Single Attached Unit in Zabarte Subd., QC ₱ 5,130,000.00

Brand New Single Attached Unit in Zabarte Subd., QC

₱ 5,130,000.00BRAND NEW 2-STOREY SINGLE ATTACHED UNIT located in Zabarte Subd., Quezon City Features: 3 bedrooms, 3 toilet & bath, 1-car garage Lot area: 64.6 SQM Indoor area: 68 SQM Total developed area: 94 SQM Selling price: P5,130,000.00* *miscellaneous fees NOT included For more details and viewing appointment, please contact me. “STRICTLY FOR DIRECT BUYERS ONLY” […]