The Home Development Mutual Fund, more commonly known as Pag-IBIG Fund, is a government agency in the Philippines that provides housing and financial assistance to its members. For many Filipinos, owning a home is a dream come true, and Pag-IBIG’s housing loan program is designed to make that dream a reality. This article aims to shed light on the Pag-IBIG loan requirements, helping aspiring homeowners understand the process and prepare themselves to take the necessary steps towards affordable housing finance.

Membership Eligibility

To be eligible for a Pag-IBIG housing loan, you must first be a member of the Pag-IBIG Fund. Membership is open to all Filipino citizens, whether employed locally or abroad, self-employed individuals, or voluntary contributors such as non-working spouses or even overseas Filipinos.

Membership Contribution

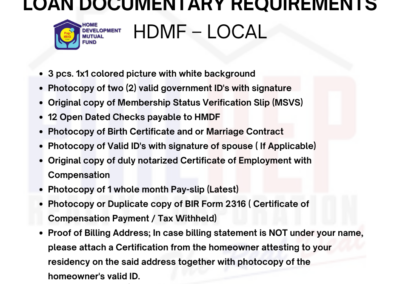

To qualify for a Pag-IBIG housing loan, you need to meet the minimum contribution requirement. The mandatory monthly contribution is Php 200 for locally employed members, while voluntary and self-employed members can choose a monthly contribution amount ranging from Php 200 to Php 2,950.

Age and Capacity to Borrow

Applicants must be 21 years old at the time of loan application and not older than 65 years old upon loan maturity. Additionally, the borrower must have the legal capacity to acquire and encumber real property, meaning they should not have any legal impediments to their ability to take out a loan.

Consistent Source of Income

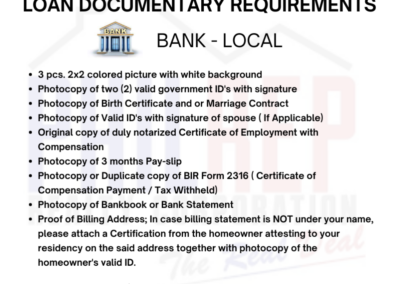

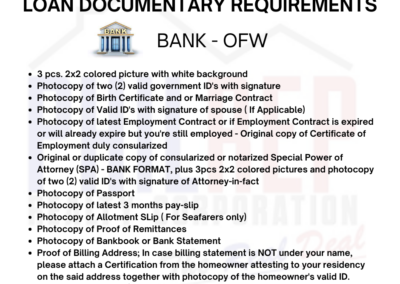

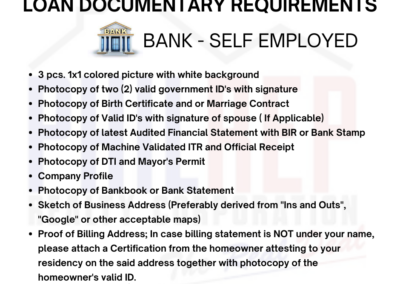

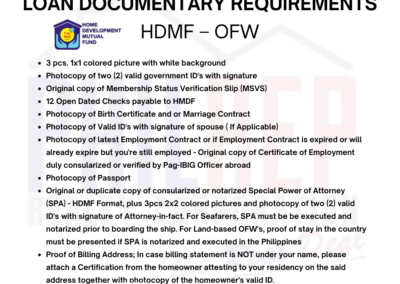

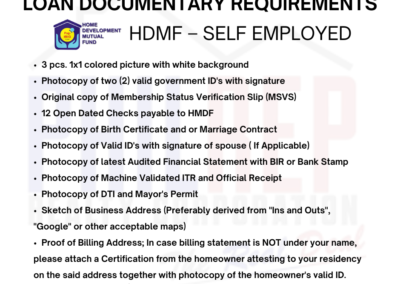

To demonstrate repayment capability, applicants must have a stable source of income. Employed members should provide their latest payslips and a Certificate of Employment and Compensation, while self-employed individuals need to submit audited financial statements, income tax returns, and other supporting documents.

Sufficient Loan Entitlement

The amount of loan you can apply for will depend on your Pag-IBIG membership contributions, the loan’s purpose, and your capacity to pay. Pag-IBIG sets a maximum loan amount that members can borrow, which can change over time based on prevailing interest rates and other factors.

Loan Approval Process

Once you’ve submitted all required documents, Pag-IBIG will evaluate your loan application. The process may take several weeks, so patience is essential. During this period, Pag-IBIG will conduct a credit investigation, assess your capacity to pay, and appraise the property you intend to buy.

Loan Terms and Interest Rates

Pag-IBIG offers competitive interest rates, making its housing loans attractive to borrowers. Loan terms can vary, with the maximum term extending up to 30 years, giving borrowers the flexibility to choose a repayment period that suits their financial capacity.

For assistance on PagIBIG loanable properties, you may contact

Broker Rhodora Sto Tomas

09228135914

0917 1631625

Broker.doah@philrep.com.ph